By Nicki Bourlioufas

Shares in Australia’s biggest wine company Treasury Wine Estates have rebounded on speculation that wine exports could resume to China in 2023 and analysts expects its run to continue in 2023 as Australia’s relation with China thaw and lockdowns lift after huge nationwide protests against Covid restrictions.

Treasury Wine Estates has been one of the worst corporate casualties of friction with China in recent years. Beijing began an anti-dumping probe into Australian wine imports in 2020 and that concluded with China slapping a combined anti-dumping and countervailing duty rate of 175.6% on Treasury’s Australian country of origin wine in containers of two litres or less imported into China – that is, all bottled wine sold in China. That hit Treasury hard, with China then the company’s (and the nation’s) largest export market.

But markets are speculating those duties could be wound back next year.

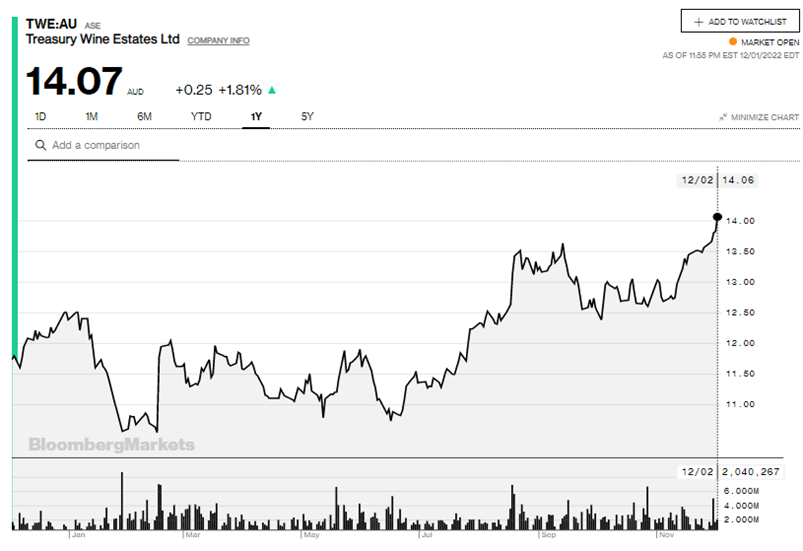

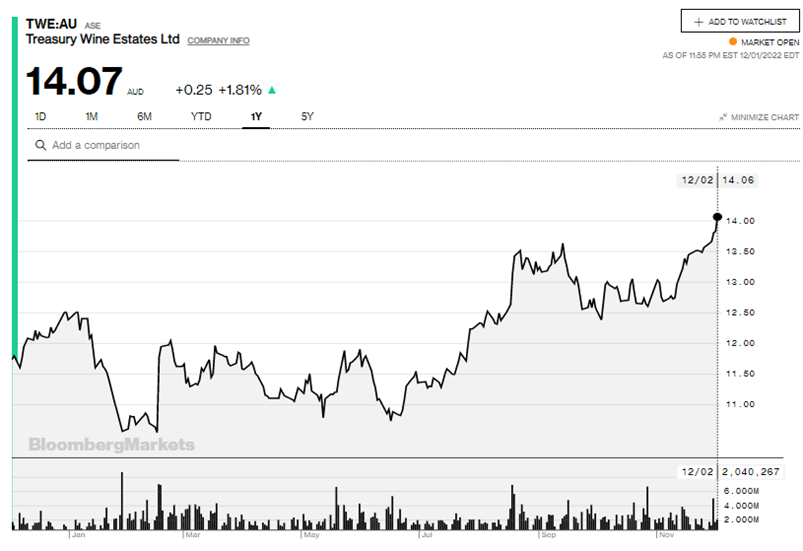

Since the change of federal government in Australia in May, there has been increasing communication between the two countries, culminating in a meeting between the Chinese leader Xi Jinping and Prime Minister Anthony Albanese earlier this month at the G20 summit, the first offiical meeting since 2016. This is a sign of easing tensions between the two nations, opening the way for the lifting of the punitive wine duties. On this speculation, Treasury’s shares have rallied hard, gaining around 8% in November and around 20% over the last since months.

This represents a sharp turnaround from November 2020 when its shares fell from $19 to a low of just below $9 in response to China’s wine duties.

‘Well-managed’ company trades out of crisis

Since the change of federal government in Australia in May, there has been increasing communication between the two countries, culminating in a meeting between the Chinese leader Xi Jinping and Australian Prime Minister Anthony Albanese earlier this month at the G20 summit, the first official meeting since 2016. The easing of tensions between the two nations may open the way for the lifting of the punitive wine duties, sending Treasury’s shares higher. Its stock has gained around 10% over the past month, and around 21% over the last since months compared to a gain of 2% for the S&P/ASX 200. This represents a sharp turnaround from November 2020 when its shares fell from $19 to a low of just below $9 in response to China’s wine duties.

‘Well-managed’ company trades out of crisis

Since its 202 lows, TWE has successfully worked on selling its wine in other export markets. Treasury is hoping that a new strategy to produce wine in China and sell it in France and the US will help to rebuild its Chinese business. Last month, the company launched a new China-made red blend priced at 228 yuan a bottle aimed at urban, Gen-Z consumers in China, branded “One by Penfolds”.

“We’re a big believer that we will rebuild a business over multiple years in China,” the firm’s chief executive, Tim Ford, told Reuters earlier this month.

According to Morgans analyst Belinda Moore, the foundations are now in place for TWE to deliver strong double-digit earnings growth from 2022-23. “Pleasingly, the benefits of its new divisional model are clearly evident and the Penfolds reallocation strategy has been a success,” she said in a statement.

“TWE has initiatives in place to deliver strong earnings growth out to FY25,” she said. “With 20% upside [TBC] to our new price target and the stock trading on an FY23/24 PE of 24.0/20.4x (long-term average is 25x) and at a discount to other luxury brand owners, we remain buyers of this well-managed company.”

Treasury reported strong growth across its key premium and luxury in the first quarter of 2022-23 with its earnings before interest and tax rising 27% in the first quarter to $79.6 million and its margins widening by 2.5 percentage points, highlighting its increasing profitability, despite rising cost pressures. It says it has seen “particularly pleasing growth in selected Asian markets outside China, as well as parts of Europe and the US”. To enhance capacity in its French wine portfolio, the company announced the majority purchase of Chateau Lanessan in Bordeaux in August 2022. The company expects the transaction to complete this month and will continue the involvement of the Bouteiller family, which has overseen the historic property for several generations.

“With proven redirection of Penfolds China volumes as well as refocusing Treasury Americas on premium/luxury, TWE is now re-entering a growth phase with a more diverse and defensive business,” the investment bank said in a research note. Goldman has a buy rating on Treasury Wine with a 12-month share price target of $14.70.